Customs Duties and E-commerce: The New Challenge for European Businesses

What to expect and how to prepare for new economic scenarios

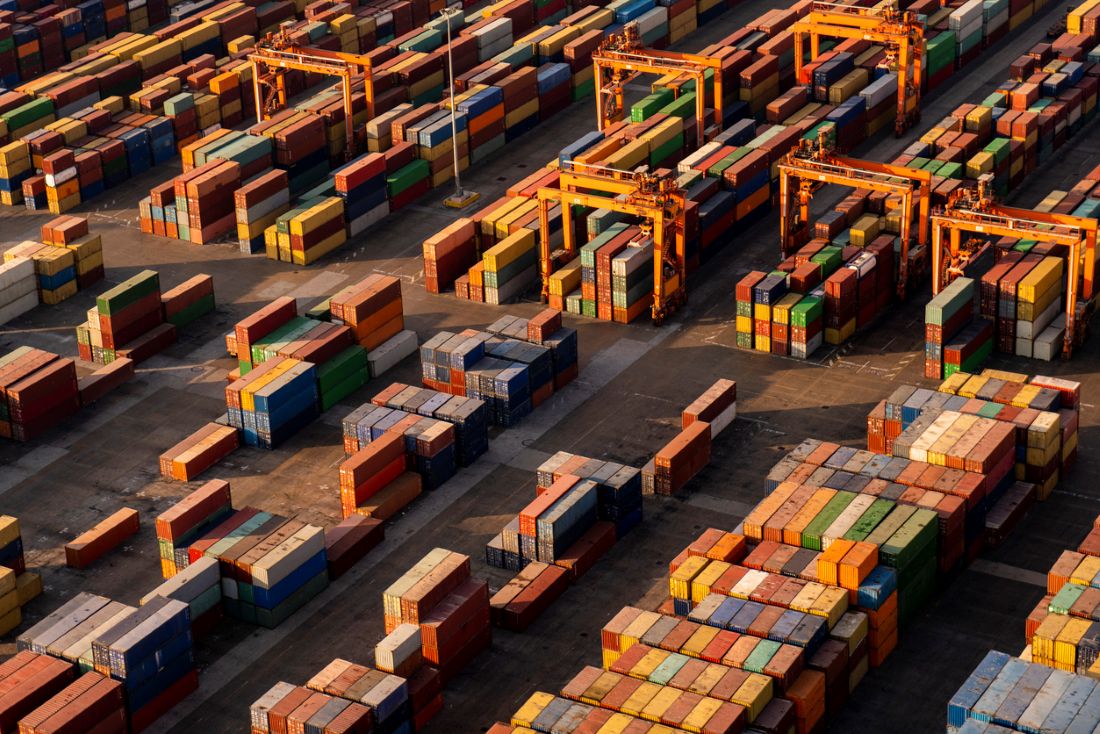

In recent months, trade tensions between the United States and the European Union have returned to the spotlight, with significant repercussions for European companies exporting overseas. The new global context, marked by the return of protectionist policies by the USA, has reignited the debate on customs duties, particularly on steel, aluminium, and industrial goods.

Following a period of relative calm, 2025 marked a turning point: the US administration announced the reintroducing of duties on European metals, reigniting the trade conflict. The European Union hit back with a €26 billion retaliatory move, introducing tariffs on American goods, including important sectors of the economy.

In early April 2025, the European Commission proposed a "zero-zero" agreement to abolish duties on industrial goods mutually. However, Washington has not yet given an official response, leaving businesses and operators in a situation of significant uncertainty.

How Customs Duties Work

Customs duties are taxes applied to goods crossing international borders. Their amount varies based on:

- The value of the goods.

- The customs code (HS code).

- Bilateral agreements in force between the involved countries.

Businesses, especially those operating via e-commerce, must stay updated on regulatory changes to avoid delays, penalties or unexpected additional costs.

The Consequences for European E-commerce

Although digital commerce may seem 'intangible', every online order involves the physical shipment of a product. Customs duties directly influence:

- The final cost of the products.

- Delivery times.

- Customer satisfaction.

For European e-commerce operators, this signifies a need to rethink pricing, delivery systems, and customer service strategies. Duty increases can reduce competitiveness, pushing consumers towards cheaper and faster alternatives.

Furthermore, increased customs checks can lead to delays and temporary blockages, creating greater uncertainty, critical factors for e-commerce, where speed is essential to the purchasing experience.

Marketplaces and Dropshipping: The Most Exposed

Those operating in dropshipping or selling through global marketplaces like Amazon, eBay, or Etsy are among the most affected. These business models rely on international shipments with already limited margins: the introduction or increase of duties can make them unsustainable.

Difficulties include:

- Unexpected customs clearance costs;

- Packages being blocked or returned;

- Greater complexity in returns management.

How to Prepare: Strategies to Face Uncertainty

To mitigate the impact of new trade measures, companies must adopt preventive and flexible strategies:

- Constant Regulatory Monitoring: Following official sources like government bodies and Chambers of Commerce to anticipate tariff changes and adapt your operations.

- Supply Chain Review: Investing in warehouses located within the EU or in logistics partners in countries with favourable agreements can reduce exposure to duties. Logistic triangulation is also an effective option to optimise shipments and costs.

- Transparent Communication with Customers: Informing customers about any changes in costs or delivery times helps maintain trust and customer loyalty, preventing complaints or negative reviews.

Face Changes with the Right Support

In such a dynamic context, it is fundamental to rely on expert partners. Mail Boxes Etc. supports businesses, professionals, and e-commerce with:

- Personalised customs consultancy;

- Complete international shipping procedures;

- Logistics optimisation management according to new regulatory scenarios.

Thanks to its extensive network of Business Solutions Centres and a consolidated experience in the market, Mail Boxes Etc. is the ideal partner to overcome customs and logistical challenges.